Building a Southeast Hub for Global Food Imports

By Troy Snelson

Most food and beverage importers choose distribution hubs based on where their customers are located. They look at population density, retail concentration, and major metro areas. This approach makes intuitive sense, which is exactly why it often costs more than necessary.

The smarter calculation considers where products enter the country, how duties and warehousing costs accumulate, what compliance requirements exist, and which locations provide the best combination of port access and distribution reach. For food, beverage, and CPG brands importing through East Coast ports, the Atlanta-Savannah corridor consistently delivers advantages that other Southeast or Mid-Atlantic options can’t match.

What This Guide Covers

- The operational advantages of combining port access with inland distribution

- How Foreign Trade Zones reduce costs and improve cash flow for importers

- FDA and FSMA compliance requirements for food and beverage storage

- Why integrated logistics operations matter for import efficiency

- The practical requirements for establishing Southeast distribution

The Geographic Equation: Port Access Plus Distribution Reach

The Port of Savannah ranks as the fourth-largest container port in North America and handles the second-highest volume on the East Coast. In 2024, prepared foods and beverages moving through Savannah reached $1.2 billion in value, up 22% year-over-year. Refrigerated cargo grew 12% during the same period. European chocolates, Asian specialty foods, Latin American beverages, and premium spirits move through this gateway daily.

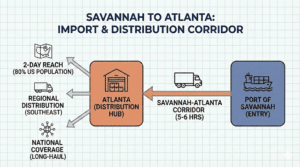

What matters more than volume is what happens after containers clear customs. Atlanta sits 250 miles inland, connected to Savannah by Interstate 16 and two Class I railroads. Standard truck transit takes 5-6 hours. Containers clearing customs in the morning typically reach Atlanta warehouses by afternoon. This proximity creates the foundation for efficient import operations.

From Atlanta, distribution mathematics become compelling. The city provides truck access to 80% of the U.S. population within two days. Three major interstates (I-20, I-75, I-85) converge here, creating natural freight corridors north, south, east, and west. Major Southeast markets including Charlotte, Nashville, Tampa-Orlando, and Miami sit within a day’s drive. More than 100 million consumers live within a 10-hour radius.

For imported products, this geography means faster regional delivery and national reach from a single warehousing location. Brands that initially plan for multi-site distribution often discover they can serve most U.S. customers from Georgia alone.

Foreign Trade Zones: The Cash Flow Advantage

When imported products move from Savannah to FTZ-designated warehouses in the Atlanta area, importers don’t pay customs duties until products leave the warehouse and enter U.S. commerce. For brands holding 60-90 days of inventory, that’s two to three months of deferred duty payments. The cash flow impact is straightforward: your working capital isn’t tied up in duties on unsold inventory.

Additional FTZ benefits include:

- Weekly customs entry filing regardless of shipment frequency, reducing processing fees

- Duty elimination on products re-exported from the zone

- Potential duty reduction for products processed or packaged within the zone

- Possible exemption from state and local inventory taxes on goods held in the zone

Many Atlanta-area food-grade warehouses already operate under FTZ designation. Importers can use these facilities without establishing their own FTZ status. The warehouse handles compliance and reporting while you receive the financial benefits.

FDA Compliance and Food-Grade Storage Requirements

Every food and beverage product sold in the United States must meet FDA regulations and Food Safety Modernization Act requirements. Storage facilities must be FDA-registered and maintain specific standards for cleanliness, temperature control, pest prevention, and product traceability.

Temperature-sensitive products require additional attention. Confectionery, premium chocolates, wine, craft beer, and specialty beverages often need mid-temperature storage (55-75°F) to maintain quality. A warehouse claiming food-grade certification should have documented temperature monitoring, alarm systems for out-of-range conditions, and staff trained in proper handling procedures for food and beverage products.

Alcoholic beverage imports add another compliance layer. Products must meet TTB requirements, often need state-specific labeling, and face different regulations in each state market. Working with logistics providers experienced in alcohol distribution helps navigate these complications.

The Atlanta region includes multiple FDA-registered facilities equipped for CPG, beverage, pharmaceutical, and specialty food storage. Atlanta Bonded Warehouse operates 16 such facilities across six states, providing the infrastructure importers need to meet U.S. regulatory requirements from the start.

Integrated Operations: Why Single-Provider Logistics Matter

Import operations involve more than storage. Containers must be picked up from the port, moved to warehouses, potentially labeled or repackaged for U.S. markets, then distributed to retail customers or direct-to-consumer channels. Managing these steps across multiple vendors creates coordination problems and increases the chance of delays or errors.

Established Southeast logistics providers offer integrated transportation, warehousing, and value-added services under one operational umbrella. This integration means one point of contact, unified technology systems for tracking shipments, and a single entity accountable for the entire supply chain from port to customer for those customers who have not negotiated door rates to the distribution center.

For imports requiring co-packaging, labeling, or kitting before distribution, having these services available at the same facility where products are stored eliminates the need to move inventory between locations. This saves time and reduces handling risk for fragile or temperature-sensitive items like wine, spirits, snacks, or confectionery.

Market Growth and Infrastructure Investment

The Southeast represents the fastest-growing U.S. region by population. This growth drives increased consumer demand for specialty foods, imported beverages, international products, and premium CPG brands. Establishing distribution in Atlanta positions your products in a growing regional market while maintaining access to national accounts.

Georgia continues investing in transportation infrastructure, port improvements, and logistics facilities. The state consistently ranks among the top business environments in the country, supported by policies that facilitate international trade and distribution operations. This infrastructure development benefits importers looking to establish long-term distribution presence in the Southeast.

Frequently Asked Questions

What documentation is required for food imports through Savannah?

Food imports require FDA prior notice submitted 2-8 hours before arrival, customs entry documentation, commercial invoice and packing list, and any product-specific certifications like organic or kosher designations. Your customs broker will guide you through category-specific requirements.

How do FTZ benefits work if I don’t establish my own zone?

Many warehouses already operate under FTZ designation. When you store products in these facilities, you receive FTZ benefits without managing zone administration yourself. The warehouse operator handles all compliance, reporting, and regulatory requirements with Customs and Border Protection.

What transit times should I expect from Savannah to Atlanta?

Standard truck transport takes 5-6 hours. Containers that clear customs in the morning typically reach Atlanta warehouses the same day. Rail service is available for larger volumes and takes 24-48 hours. Most importers use truck transport for speed and flexibility.

Which products require temperature-controlled storage?

Confectionery, premium chocolates, gummies, wine, craft beer, certain spirits, and products sensitive to heat or humidity typically need mid-temperature control (55-75°F). Shelf-stable items like canned goods, packaged snacks, and ambient beverages can use standard ambient storage. Frozen or refrigerated products require cold storage facilities.

Can Atlanta serve as a single distribution point for national coverage?

Atlanta provides two-day truck access to 80% of the U.S. population, making single-site distribution viable for many brands. West Coast deliveries take 4-5 days by truck. Some importers serve West Coast markets through partnerships with regional distributors while handling the rest of the country from Georgia.

What should I look for in a Southeast logistics partner?

Verify FDA registration and food-grade facility certification. Look for FTZ capabilities, temperature-controlled storage if needed, and proven experience with imported food or beverage products. Integrated transportation and Tier 1 warehouse management systems matter for operational efficiency. Check whether they have experience with your specific product category and understand relevant regulatory requirements.

Establishing Your Southeast Presence

Building U.S. distribution for imported food and beverage products requires coordinating multiple factors: port access, regulatory compliance, cost management, and distribution logistics. The Atlanta-Savannah corridor provides established infrastructure for all of these requirements.

The operational advantages are measurable: reduced duty carrying costs through FTZ benefits, two-day distribution to most U.S. markets, FDA-compliant food-grade storage, and access to integrated logistics services. For overseas brands entering the U.S. market or expanding their distribution footprint, these advantages create tangible competitive benefits.

The infrastructure exists, the regulatory framework is established, and the distribution reach is proven. Companies with 75 years of Southeast market experience understand how to navigate these operations efficiently. For importers ready to establish their U.S. presence, the provider and their process are established. Are you exploring a Southeast distribution strategy? Reach out and let’s start the conversation.